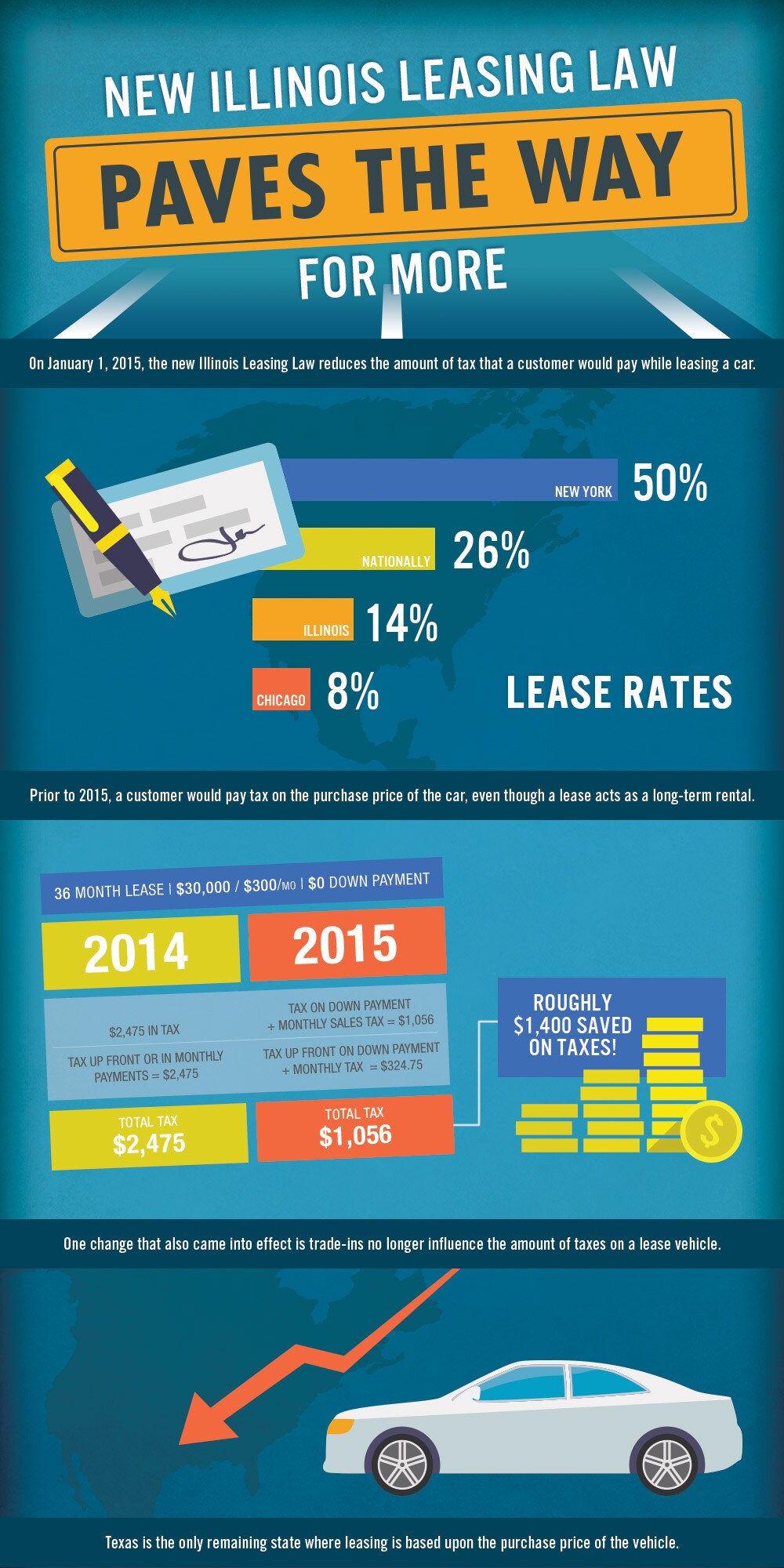

If you're taking into consideration leasing an automobile in Illinois, the state's new leasing regulation can make the process a lot more economical. Before the adjustment, consumers paid taxes on the full acquisition rate of a rented automobile, which caused higher expenses, despite the fact that leases function even more like leasings. The brand-new regulation, which entered into effect on January 1, 2015, enables tax obligations to be used just to the down settlement and the regular monthly payments. This shift can lead to significant savings-- approximately $1,900 sometimes. As an example, a $30,000 car leased for 36 months saw the overall tax obligation bill decline from $2,475 to around $1,056, a cost savings that might influence numerous customers to think about leasing over acquiring.

The upgraded regulation also eliminated the impact of trade-ins on the tax obligation price for rented automobiles. Formerly, the trade-in worth of a vehicle can lower the purchase rate of a lease, inevitably decreasing the taxes owed. While this adjustment might have an influence on those made use of to utilizing trade-ins as a tax obligation countered, the regulation still represents an action toward making lorry leasing in Illinois a lot more similar to the national requirement. Whether you are new to leasing or an experienced pro, comprehending how the new legislation affects your lower line can make a huge distinction in how much you wind up paying over the term of your lease.

Check for more info at Bill Walsh Kia Facebook Twitter

Navigation

Latest Posts

Specialist Vehicle Service at Willis Chevrolet of Granger

Streamline Your Mitsubishi Purchase with Basil Mitsubishi Financing

The Ultimate Lexus Ownership Experience